Lucid Announces Fourth Quarter and Full Year 2021 Financial Results, Updates 2022 Outlook

- Customer reservations now exceed 25,000, reflecting potential sales of more than $2.4B

- Inaugural customer deliveries of the 2022 MotorTrend Car of the Year®, the Lucid Air, are underway, starting with the sold-out Dream Edition

- Production exceeds 400 vehicles as of February 28, 2022, with 125 customer deliveries as of year-end 2021 and over 300 deliveries to date

- Updating 2022 production outlook for Lucid Air to a range of 12,000 to 14,000 vehicles

- Selected to the Nasdaq-100 Index in December, issued $2B in green convertible bonds, and bolstered balance sheet to over $6.2B cash on hand at year-end

- 2.85 million square foot expansion of Casa Grande, Arizona manufacturing facility on track; announced plans for new manufacturing facility in the Kingdom of Saudi Arabia

NEWARK, CA — February 28, 2022 — Lucid Group, Inc. (NASDAQ: LCID), setting new standards with the longest range, fastest charging electric car on the market, today announced financial results for its fourth quarter and full year ending December 31, 2021.

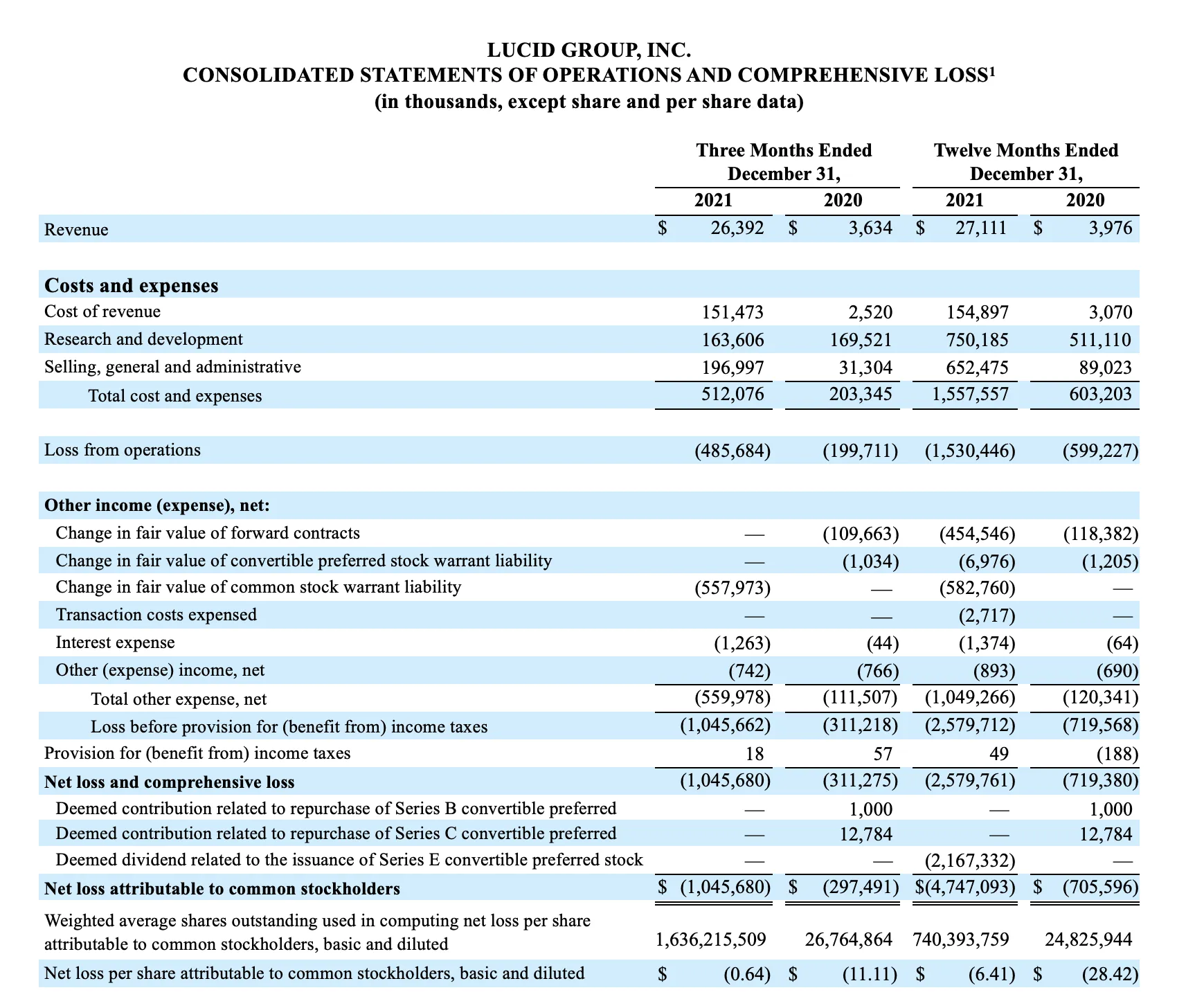

The Company’s Q4 revenue was $26.4 million, including $21.3 million from initial deliveries of its innovative Lucid Air Dream Edition, which began in October. Lucid delivered 125 cars to customers in the fourth quarter, with total production exceeding 400 vehicles to date and over 300 deliveries to customers. Lucid has also taken over 25,000 customer reservations as of today, reflecting potential sales of more than $2.4B. The Company confirmed its 2.85M square foot expansion of the Casa Grande, Arizona manufacturing facility is on track, and it announced plans to build a new manufacturing facility in the Kingdom of Saudi Arabia. Lucid cited supply chain constraints and a continued focus on quality alongside an updated outlook for its 2022 production of Lucid Air to a range of 12,000 to 14,000 vehicles.

“We are at the precipice of a global transition toward electric vehicles, and Lucid, with our leading technology and design, is at the forefront of one of the most significant transformations in mobility in generations,” said Peter Rawlinson, Lucid’s CEO and CTO. “As we continue to put our cars into customers’ hands, we are more confident than ever that we’re building a quality foundation on which we can scale this business. We’re thrilled to have been awarded the 2022 MotorTrend Car of the Year®, and customers are telling us just how much they love this car. Lucid Air’s 500-plus miles of range has been independently validated under real-world conditions, even at a steady 70mph, replacing range anxiety with range confidence. We believe that the unique fusion of a dynamic driving experience, interior space and comfort, range, fast charging and performance is simply unparalleled. Additionally, our software over-the-air updates continue to enable an ever-improving ownership experience.”

“Looking ahead, we’re updating our outlook for 2022 production to a range of 12,000 to 14,000 vehicles. This reflects the extraordinary supply chain and logistics challenges we’ve encountered and our unrelenting focus on delivering the highest-quality products. We remain confident in our ability to capture the tremendous opportunities ahead given our technology leadership and strong demand for our cars,” Rawlinson added.

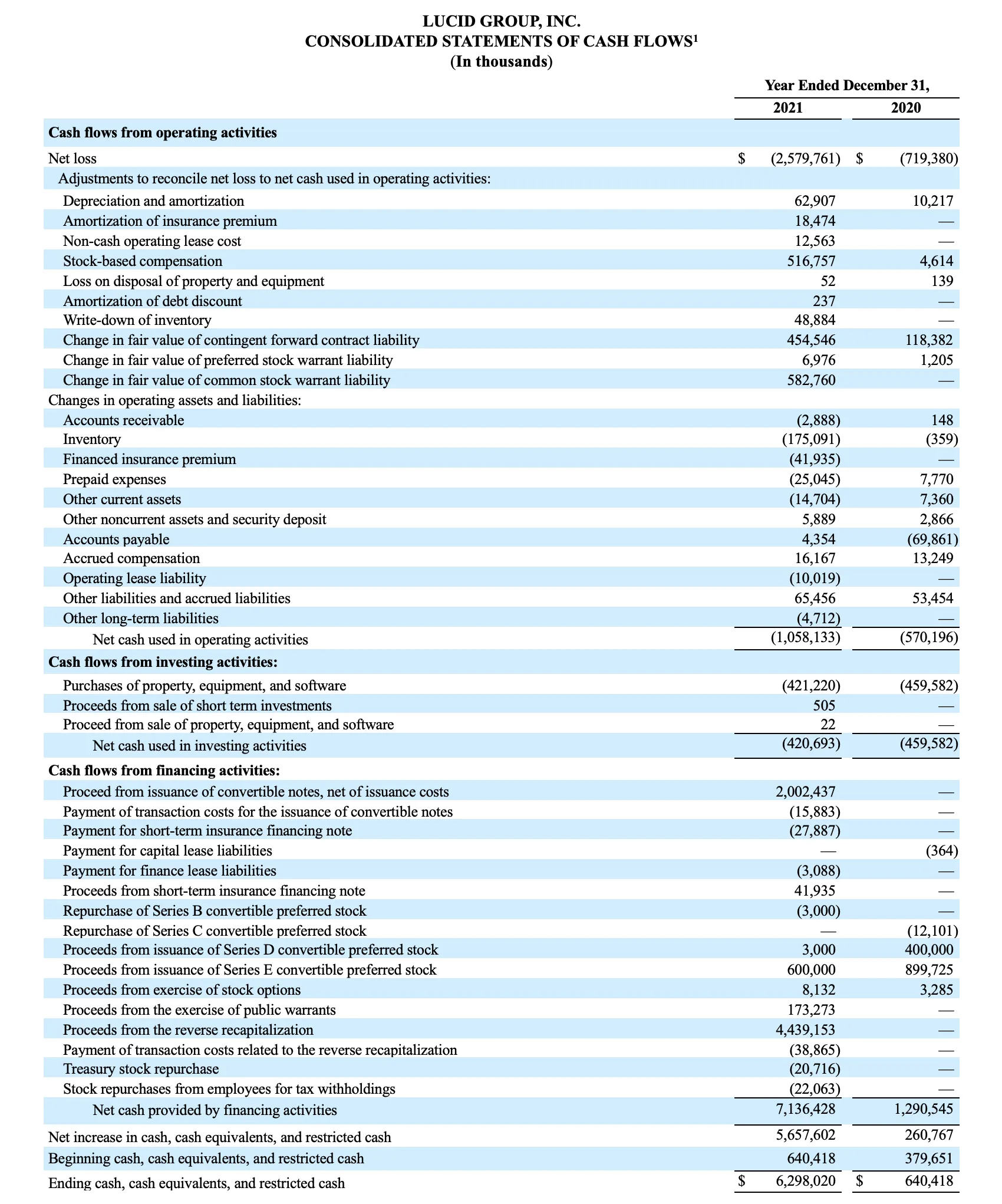

Sherry House, Lucid’s CFO, commented: “We have a strong team, strong products, and a strong balance sheet with over $6.2 billion in cash on hand at year-end. We continue to invest in our business; we met our target of opening 20 Studio and Service locations in North America; in 2022 we will expand our footprint in Europe and the Middle East while laying the foundation for a later expansion into the Asia Pacific; we remain on track to grow our Casa Grande facility to nearly quadruple its size as the first greenfield dedicated EV factory in North America; and today we announced plans to build a brand new manufacturing facility in the Kingdom of Saudi Arabia; we estimate that the location of our first international manufacturing plant in the Kingdom of Saudi Arabia may result in up to $3.4 billion of value to Lucid over 15 years.”

Lucid will host a conference call for analysts and investors at 2:30 P.M. PT / 5:30 P.M. ET on February 28, 2022. The live webcast of the conference call will be available on the Investor Relations website at ir.lucidmotors.com. Following the completion of the call, a replay will be available on the same website. Lucid uses its ir.lucidmotors.com website as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

About Lucid Group

Lucid’s mission is to inspire the adoption of sustainable energy by creating advanced technologies and the most captivating luxury electric vehicles centered around the human experience. The company’s first car, Lucid Air, is a state-of-the-art luxury sedan with a California-inspired design that features luxurious full-size interior space in a mid-size exterior footprint. Underpinned by race-proven battery technology and proprietary powertrains developed entirely in-house, Lucid Air was named the 2022 MotorTrend Car of the Year®. The Lucid Air Dream Edition features an official EPA estimated 520 miles of range or 1,111 horsepower. Customer deliveries of Lucid Air, which is produced at Lucid’s factory in Casa Grande, Arizona, are underway.

Forward Looking Statements

This communication includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding financial and operating guidance, amount of reservations and related potential sales, future capital expenditures and other operating expenses, expectations and timing related to commercial product launches, production and delivery volumes, our estimate of the length of time our existing cash will be sufficient to fund planned operations, the timing of deliveries, future manufacturing capabilities and facilities, studio and service center openings, providing value to stakeholders, ability to mitigate supply chain risks and logistics, ability to vertically integrate production processes, future sales channels and strategies, future market launches and international expansion, including our planned manufacturing facility in Saudi Arabia and related timing and value to Lucid, and the potential success of Lucid’s go-to-market strategy and future vehicle programs. These statements are based on various assumptions, whether or not identified in this communication, and on the current expectations of Lucid’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Lucid. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; risks related to the timing of expected business milestones and commercial product launches, including Lucid’s ability to mass produce the Lucid Air and complete the tooling of its manufacturing facility; risks related to the expansion of Lucid’s manufacturing facility, the construction of new manufacturing facilities and the increase of Lucid’s production capacity; risks related to future market adoption of Lucid’s offerings; the effects of competition and the pace and depth of electric vehicle adoption generally on Lucid’s future business; changes in regulatory requirements, governmental incentives and fuel and energy prices; Lucid’s ability to rapidly innovate; Lucid’s ability to enter into or maintain partnerships with original equipment manufacturers, vendors and technology providers; Lucid’s ability to effectively manage its growth and recruit and retain key employees, including its chief executive officer and executive team; potential vehicle recalls; Lucid’s ability to establish its brand and capture additional market share, and the risks associated with negative press or reputational harm; Lucid’s ability to manage expenses; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; and the impact of the global COVID-19 pandemic on Lucid's projected results of operations, financial performance or other financial metrics, or on any of the foregoing risks; and those factors discussed under the heading “Risk Factors” in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, as well as other documents Lucid has filed or will file with the Securities and Exchange Commission. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Lucid presently does not know or that Lucid currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Lucid’s expectations, plans or forecasts of future events and views as of the date of this communication. Lucid anticipates that subsequent events and developments will cause Lucid’s assessments to change. However, while Lucid may elect to update these forward-looking statements at some point in the future, Lucid specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Lucid’s assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-GAAP Financial Measures and Key Business Metrics:

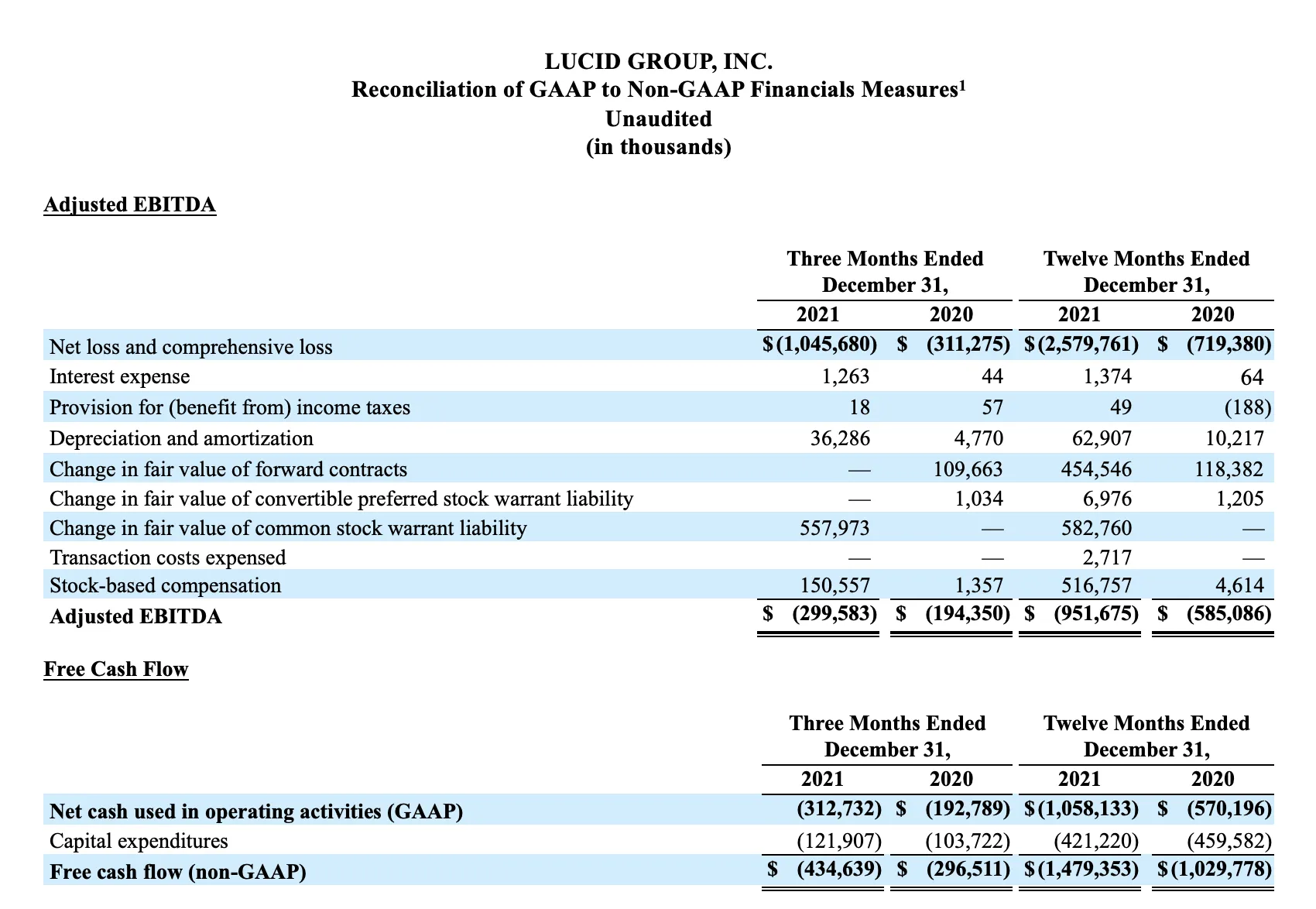

Consolidated financial information has been presented in accordance with US GAAP (“GAAP”) as well as on a non-GAAP basis to supplement our consolidated financial results. Lucid’s non-GAAP financial measures include Adjusted EBITDA and Free Cash Flow which are discussed below.

Adjusted EBITDA is defined as net loss and comprehensive loss before (1) interest expense, (2) provision for (benefit from) income taxes, (3) depreciation and amortization, (4) change in fair value of forward contracts, (5) change in fair value of convertible preferred stock warrant liability, (6) change in fair value of common stock warrant liability, (7) transaction costs expensed and (8) stock-based compensation. Adjusted EBITDA is a performance measure that Lucid believes provides useful information to Lucid’s management and investors about Lucid’s profitability. Free Cash Flow is defined as net cash used in operating activities less capital expenditures. Free Cash Flow is a performance measure that Lucid believes provides useful information to Lucid’s management and investors about the amount of cash generated by the business after necessary capital expenditures.

These non-GAAP financial measures facilitate management’s internal comparisons to Lucid’s historical performance. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting, and financial planning purposes. Management also believes that presentation of the non-GAAP financial measures provides useful information to Lucid’s investors regarding measures of our financial condition and results of operations that Lucid uses to run the business and therefore allows investors to better understand Lucid’s performance. However, these non-GAAP financial and key performance measures have limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP.

Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under GAAP when understanding Lucid’s operating performance. In addition, other companies, including companies in our industry, may calculate non-GAAP financial measures and key performance measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures and key performance measures as tools for comparison. A reconciliation between GAAP and non-GAAP financial information is presented below.

Investor Relations Contact

investor@lucidmotors.com

Media Contact

media@lucidmotors.com

¹ The business combination (the “Merger”) between Lucid Group Inc.’s predecessor, Atieva, Inc. (“Legacy Lucid”), and Churchill Capital Corp IV (“CCIV”), which closed on July 23, 2021, is accounted for as a reverse recapitalization under U.S. GAAP. Under this method of accounting, CCIV has been treated as the acquired company for financial reporting purposes. Accordingly, for accounting purposes, the financial statements of Lucid represent a continuation of the financial statements of Legacy Lucid with the Merger being treated as the equivalent of Legacy Lucid issuing shares for the net assets of CCIV, accompanied by a recapitalization. The net assets of CCIV were recognized as of the closing of the Merger at historical cost, with no goodwill or other intangible assets recorded. Operations prior to the Merger are presented as those of Legacy Lucid and the accumulated deficit of Legacy Lucid has been carried forward after the closing of the Merger. All periods prior to the Merger have been retrospectively adjusted using the applicable exchange ratio for the equivalent number of shares outstanding immediately after the closing of the Merger to effect the reverse recapitalization. See our Form 10-K for the year ended December 31, 2021 for additional information.